CSRD: Preparing for the Corporate Sustainability Reporting Directive

Effective as of January 1st, 2024, the Corporate Sustainability Reporting Directive (CSRD), aims to standardize extra-financial reporting of companies, with the main objective of improving the availability and quality of ESG data made public. Replacing the Non Financial Reporting Directive (NFRD), the CSRD will gradually require over 50,000 companies in Europe to establish extra-financial reports on their CSR impact. In addition to extending its scope to a larger number of companies, the directive introduces new sustainability reporting requirements, forcing companies to rethink their business models. This step marks a significant turning point in the sustainability trajectory of European companies, and an improvement in the way their social and environmental impact is taken into account.

What is CSRD? What are the new sustainability reporting requirements? How can we prepare effectively for compliance? An update on CSRD and its evolution.

Sommaire

What is the Corporate Sustainability Reporting Directive (CSRD)?

CSRD: definition

The CSRD (Corporate Sustainability Reporting Directive) is a European directive that provides a framework for extra-financial reporting and imposes new obligations on companies. It replaces the NFRD (Non Financial Reporting Directive).

The CSRD has been applicable since January 1, 2024, and applies to more than 50,000 companies in the European Union, against with 11,000 under the NFRD.

What are the objectives of the CSRD?

The CSRD extends and strengthens extra-financial reporting obligations for companies operating in Europe. This directive aims to create a standard and norms for sustainability reporting, which until now has been subject to little supervision.

The main objectives of the CSRD directive are as follows:

- Harmonize extra-financial reporting by companies operating in the EU to facilitate comparisons.

- Improve the quality, accuracy and availability of ESG (environmental, social and governance) data collected thanks to a unified repository, which also improves transparency on these subjects and limits greenwashing.

- Improve the way in which companies take account of environmental and social issues, in particular through the inclusion in their reports of transition plans in line with the objectives of the Paris Agreement.

CSRD gives extra-financial data the same rigor and readability as financial data

50, 000 companies in Europe

5x NFRD

Strengthening and standardizing reporting obligations

1232 datapoints

Dedicated section of the company annual report

Single European electronic format XBRL

Statutory Auditors

“For companies, the arrival of CSRD is a major upheaval, comparable to the IFRS revolution in financial reporting in the 2000s”.

Who are the companies subject to CSRD?

The CSRD concerns large companies that meet at least two of the following criteria at the end of the financial year:

- average workforce of more than 250 employees

- total balance sheet 25 million euros

- net turnover exceeding 50 million euros

But also :

- SMEs listed on EU markets, both European and non-European

- non-European companies with European turnover exceeding 150 million euros at the close of the last two consecutive financial years.

What are changes between the NFRD and the CSRD?

The transition from NFRD to CSRD represents a significant change in the European regulatory landscape, with major implications for companies and investors alike. Companies already subject to the NFRD will be the first to be required to publish a CSRD report.

Here are the most important changes between these two ESG reporting directives.

- Extending the scope of application: the number of companies covered by extra-financial reporting requirements in Europe has risen from 11,600 to almost 50,000, including almost 6,000 in France. ’extension du champs d’application :

- The amount of information to be provided: The CSRD has also increased the volume of extra-financial information to be provided. The number of specific disclosures that companies will be required to collect and publish includes almost 1,200 data points. However, this reporting scope will be reduced as a result of the double materiality analysis.

- The introduction of the double materiality principle: this requires companies to identify ESG issues that are significant for both themselves and their stakeholders, through an impact analysis and a financial materiality analysis. The results of this analysis will also enable undertakers to determine the themes and associated datapoints on which to report (see explanation below).

- Value chain integration: The CSRD encourages companies to take their entire value chain into account in their reporting, recognizing indirect impacts and associated risks.’Intégration de la chaîne de valeur :

CSRD & Green Deal

LThe CSRD is at the heart of the European Green Pact, better known as the Green Deal, which aims to return the EU to -55% emissions by 2030 and net zero emissions by 2050. It is part of a set of 5 regulations proposed by the EU to provide a framework for European companies:

- CBAM (Carbon Border Adjustment Mechanism)

- SFDR (Sustainable Finance Disclosure Regulation)

- Taxonomy

- CSDDD (Corporate Sustainability Due Diligence Directive).

The aim of this European regulatory framework is to accelerate the ecological and social transition and combat greenwashing.

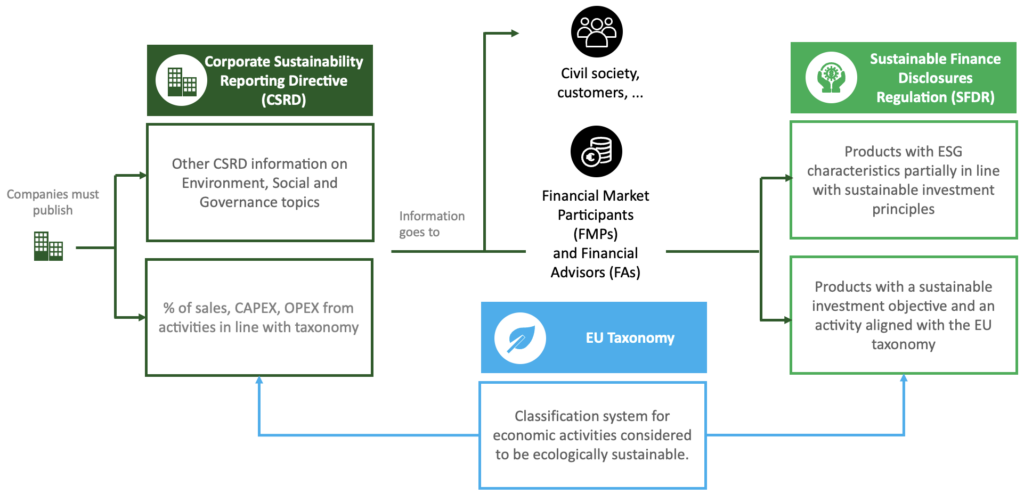

As part of the CSRD, companies must publish :

- Environmental, Social and Governance (ESG) indicators

- Percentage of sales, CAPEX, OPEX from activities in line with taxonomy

The information goes to civil society, customers, financial market participants (FMPs) and financial advisors (FAs).

Under the Sustainable Finance Disclosure Regulation (SFDR), which applies to financial products, companies must publish :

- Products with ESG characteristics that partially pursue a sustainable investment objective.

- Products with a sustainable investment objective and pursuing an activity aligned with the EU taxonomy.

Taxonomy

The European Taxonomy is a system for classifying economic activities as ecologically sustainable. This regulation aims to direct capital flows towards activities that contribute to the fight against climate change. Private companies will be required to publish information on the sustainability of their activities.

The roadmap to prepare for CSRD compliance

The CSRD is difficult to implement for companies: the number of indicators is considerable, CSR data is scattered and not very homogeneous between group subsidiaries, carbon equivalence tables are constantly evolving, and there are many frameworks. It is often difficult to measure the real impact of CSR policies, and with the CSRD audit requirement, it is essential to keep track of all information. A software approach is therefore essential.

- Governance

- Double Materiality

- Scope of reporting

- Gap analysis

- Identify data resources (ERP, dedicated tools, etc.)

- Data recovery from Carbon Footprint Report, etc.

- Policies and objectives

- Defining action plans

- Change management

- Automate the data source to the tool (API, etc.)

- Training the people in charge

- Switch to monthly/quarterly/half-yearly reporting, aligned with finance cycles

- Be able to manage quantified objectives with associated action plans

ESG Plateform

Preparing for CSRD requires a proactive and structured approach. Here are our tips for successful implementation:

1. Information and training

To build a successful CSRD approach, education is key! This step is essential to raise awareness of the links between financial and non-financial performance, and to integrate sustainability issues into overall strategy. Training your teams will enable them to grasp the texts and the issues at stake. Making people understand that ESG reporting is much more than a regulatory compliance issue, but one that concerns everyone, will help to get all stakeholders on board and motivate them around a unifying project.

To reinforce your knowledge, you can consult the numerous resources that explain the official texts in simple terms. It is also essential to keep abreast of the latest CSRD news, as clarifications are regularly provided, particularly on the obligations of companies. In addition, several organizations offer comprehensive training courses dedicated to CSRD and its implementation.

2. Organizing governance and involving stakeholders

Today, sustainability is becoming a cross-functional issue within organizations. Effective preparation for CSRD requires the involvement of all the company’s internal stakeholders. These include not only the departments traditionally involved in extra-financial reporting, such as the CSR (Corporate Social Responsibility) department or the finance department, but also other functions such as operations, supply chain, human resources and communications. It is essential to mobilize all the players involved to ensure a coherent, integrated approach to sustainability reporting.

Moreover, identifying all stakeholders within the value chain is of crucial importance in CSRD, not least to structure and streamline data collection. Karbonapth’s ESG platform makes it possible to include and manage the various stakeholders right from the double materiality analysis stage.

3. Anticipate data collection

Data collection is undoubtedly the most complex stage of CSRD. Companies can overcome the challenges associated with taking into account the entire value chain and the volume of data expected. Gathering, compiling and processing data requires a robust process The most effective way to achieve this goal is to rely on CSRD reporting software. Drawing on our expertise in data management, we have developed a solution capable of ensuring data traceability and auditability, as well as guaranteeing data consistency and validity.

Before taking the plunge, it’s essential to ask yourself the right questions:

- What is the level of information granularity in the organization?

- Where is the data located?

- How do you collect it if it isn’t already there?

- Which stakeholders need to be involved in this process?

- How can we ensure data consistency and reliability?

- How can we ensure their traceability?

From data collection to visualization and interpretation, the data module follows the entire data processing process, applying it to ESG. The platform guarantees consistent, validated, complete and traceable data.

4. Implement appropriate processes and software

Once reporting obligations have been identified and internal stakeholders mobilized, it is essential to put in place suitable processes and tools to collect, verify and produce the information required by the CSRD. This may involve implementing new data collection systems, training staff to bring them up to speed, engaging specialist third parties to support the approach, but also putting in place robust internal control mechanisms.

By adopting a rigorous, collaborative approach, companies can comply with new regulatory requirements, but also reinforce their commitment to sustainability and their contribution to a more sustainable and responsible economy.

The 12 CSRD standards applicable from January 1, 2024

ESRS: the pillars of CSRD

Companies subject to the CSRD will have to report on 12 reporting standards called ESRS. Created by EFRAG, these standards are the equivalent of IFRS for financial statements.

Information selected according to the principle of double materiality

3 levels of information to be provided

- All sectors (12 ESRS standards)

- Sector-specific (coming soon)

- Entity-specific (to be defined by entity)

4 reporting areas

- Governance

- Strategy

- Impact, risk and opportunity management (IROs)

- Metrics and targets

Large volume

- 1232 data points

Transverse standards

ESRS 1

General requirements

ESRS 2

General disclosures

Environnement

ESRS E1

Climate change

ESRS E2

Pollution

ESRS E3

Water and marine ressources

ESRS E4

Ecosystems and biodiversity

ESRS E5

Resource use and circular economy

Social

ESRS S1

Own workforce

ESRS S2

Workers in the value chain

ESRS S3

Affected communities

ESRS S4

Consumers and end-users

Governance

ESRS G1

Business conduct

Focus on the 12 ESRS standards

ESRS 1: General requirements

This standard does not provide disclosure requirements, but presents the conceptual framework, how to prepare the information (scope of publication, categories of standards, presentation of dual materiality analysis) and defines the structure of ESRS.

ESRS 2: General information

This standard comprises 12 disclosure requirements (DR): general, governance (GOV), strategic (SBM) and related to Impacts, Risks and Opportunities (IRO).

The 5 environmental standards set out the requirements to be met with regard to climate change, pollution, water and marine resources, biodiversity and ecosystems, and resource use and the circular economy.

ESRS E1: Climate change

Explain the company’s process for moving to a sustainable, low-carbon economy. Climate change mitigation, climate change adaptation, energy.

ESRS E2: Pollution

The company must disclose its actions to avoid and reduce pollution, including any phase-out of materials or components having a significant negative impact, but also to restore, regenerate and transform ecosystems where pollution has occurred.

ESRS E3: Aquatic and marine resources

The company indicates whether and how its policies deal with water management, both in its supply and in its use in the design of products and services, and what its commitment is to reducing the material consumption of water in at-risk areas as part of its own activities and throughout the upstream and downstream value chain.

ESRS E4: Biodiversity and ecosystems

If the company has a plan, it must disclose its contribution to biodiversity impact factors and mitigation measures, key dependencies and assets and resources, offsets, implementation,

etc.

If the company has not adopted a plan, it must explain its ambition in terms of biodiversity and ecosystems, and must indicate if and when it will adopt a transition plan.

ESRS E5: Resource use and circular economy

The company must indicate the objectives it has adopted with regard to resource use and the circular economy: abandoning or minimizing the extraction of non-renewable virgin resources, contributing to the regenerative production of renewable resources, regenerating the ecosystems in which they are used, waste management, etc.

The 4 social standards set out the requirements for the company’s own workforce, workers in the value chain, affected communities, consumers and end-users.

ESRS S1: Company workforce

This standard applies to the company’s own workforce, both employees and non-employees, and concerns working conditions, equal treatment and opportunities for all, and other work-related rights.

ESRS S2: Workers in the value chain

This standard applies to all workers not included in the “own workforce” scope of ESRS S1 and concerns the same 3 main areas.

ESRS S3: Affected communities

The company must describe how it consults with local communities in order to respect their freedoms or obtain their informed consent when their lands or resources are affected by the company’s activity.

ESRS S4: Consumers and end-users

The company must describe how it takes into account and guarantees respect for the rights of consumers and end-users.

ESRS G1: Business conduct

A governance standard outlines the company’s culture, its management of supplier relations, its policy to avoid corruption, its commitment to political influence, including lobbying, whistleblower protection and payment practices.

Double materiality

The CSRD aims to enhance the transparency and comparability of ESG reporting by companies. The aim is to place financial and sustainability information on the same level of importance.

With the double materiality analysis, the CSRD adds to financial materiality a so-called “impact” materiality, which aims to assess how companies’ activities contribute to the degradation or improvement of the environment, and affect the well-being of populations, but also the ecological health of natural entities.

Companies must demonstrate that their commitments, strategies and indicators effectively take into account the environmental, social and governance risks generated by their activities. They must also specify the roadmap and action plans designed to limit these risks.

In concrete terms, information is said to be material when it exceeds a significant threshold, an amount beyond which economic decisions, particularly those of investors, are likely to be influenced. Double materiality analysis is therefore a crucial step in CSRD.

A key process of CSRD

Define material topics

Involve all stakeholders

IRO criteria Impact Risks Opportunities

The entire process must be auditable and traceable

Criteria set by the ESRS :

- Integration of internal and external stakeholders

- Balance between Financial Materiality and Impact Materiality

- Short-, medium- and long-term vision

- Consistency with company risk analyses

DOUBLE MATERIALITY

Impact materiality

Inside-out

Financial materiality

Outside-in

Impact of the company on the environment and society

Positive and negative impacts

Impact of the environment and society on the company’s business model

Risks and opportunities

Double materiality analysis represents a major challenge for companies. It requires the mobilization of resources and rigorous organization. However, this analysis can be transformed into an opportunity, as it takes on a strategic aspect enabling them to identify the different possible trajectories according to their impact, risks, opportunities and dependencies.

Through its solutions, Karbonpath can help you conduct your double materiality analysis while ensuring its traceability and auditability. It is possible to integrate the various stakeholders into the process, conduct materiality surveys, set materiality thresholds and deduce your reporting scope directly on the platform.

Karbonpath, a data-centric, software-based approach to the CSRD challenge

Karbonpath secures the compliance of your extra-financial reporting, in line with the CSRD.

Karbonpath makes it possible to move from strategy to action, engaging the whole organization in transformation.